- WHAT WE DO

Additional Services

- Industries

Case Study: Multilingual Retail Marketing

New AI Content Creation Solutions for a Sports and Apparel Giant

- RESOURCES

- WHO WE ARE

What We Do Home

Generative AI

- AI Translation Services

- Content Remix

AI Data Services

- Aurora AI Studio™

Machine Translation

- MT Tracker

Instant Interpreter

Customer Onboarding

Translation Service Models

Content Services

- Technical Writing

- Training & eLearning

- Financial Reports

- Digital Marketing

- SEO & Content Optimization

Translation Services

- Video Localization

- Software Localization

- Website Localization

- Translation for Regulated Companies

- Interpretation

- Instant Interpreter

- Live Events

- Language Quality Services

Testing Services

- Functional QA & Testing

- Compatibility Testing

- Interoperability Testing

- Performance Testing

- Accessibility Testing

- UX/CX Testing

Industries Home

Life Sciences Translations

- Pharmaceutical Translations

- Clinical Trial Translations

- Regulatory Translations

- Post-Approval Translations

- Corporate Pharma Translations

- Medical Device Language Services

- Validation and Clinical

- Regulatory Translations

- Post-Authorization Translations

- Corporate Medical Device Translations

- COA Translation Services

Banking & Finance

Retail

Luxury

E-Commerce

Games

Automotive

Consumer Packaged Goods

Technology

Industrial Manufacturing

Legal Services

Travel & Hospitality

Insights

- Blog Posts

- Case Studies

- Whitepapers

- Solution Briefs

- Infographics

- eBooks

- Videos

Webinars

Lionbridge Knowledge Hubs

- Positive Patient Outcomes

- Modern Clinical Trial Solutions

- Patient Engagement

- AI Thought Leadership

SELECT LANGUAGE:

As the industry prepares for the Date of Application (DoA) of the new Medical Device Regulation (MDR), the Lionbridge Life Sciences experts are here to support companies with all their regulatory translation and localization needs.

The DoA of the MDR 2017/745 is only a few weeks away. Despite the continued pandemic lockdown, there is no current indication of further delays of the new European regulation. In April 2020, COVID-19 caused the European Commission to delay the DoA of the MDR by one year, from 26 May 2020 to 26 May 2021.

While the DoA delay was intended to allow focus on the exceptional circumstances of the pandemic, it did not prompt a corresponding delay to the critical cutoff date, 26 May 2024. This date is when certificates under the current Directives become invalid.

Nor has it led to a delay of the new In Vitro Diagnostic Regulation (IVDR) 2017/746 which is still expected to legally apply from 26 May 2022. The looming deadlines of MDR in just two months and the IVDR next year continue to drive concerns about noncompliance and products being pulled from the market.

As a long-term service provider to the MedTech industry, Lionbridge sees the burden our clients face preparing for the new regulations while another wave of the pandemic sweeps over the MedTech landscape.

The challenge that many manufacturers face in transitioning to the MDR makes me think of a quote from the American researcher, professor and mindfulness expert Jon Kabat-Zinn: “You can’t stop the waves, but you can learn to surf”. This is very much a reality of our clients. The MDR is approaching fast and manufacturers need to learn how to keep their balance to prevent drowning in regulatory changes.

Why is the E.U. market so important for medical devices and invitro diagnostics?

The new E.U. regulations for medical devices and IVDs are implemented to obtain a transparent, robust and sustainable framework which will be recognized outside the European market. Whether you are a manufacturer residing in E.U. or an importer of devices from a third country, the incentive to enter the E.U. market is obvious: the European Union is the second-largest market for medical devices (after the US).

With a wealthy, multilingual and aging population of over 500 million consumers, the E.U. boasts 500,000 medical technologies registered and 27,000 established MedTech companies.

The MedTech sector in Europe employs over 675,000 people and operates across 24 different languages. In 2019, the market was estimated at €115 billion. Since the CE marking can be leveraged in other markets, the regulatory reforms in Europe are a center of attention for all international manufacturers and importers that operate within the MedTech sector.

Content and Guidance for MDR Compliance to Nearly Double

During the transition phase from current Directives to the MDR/IVDR, manufacturers have been strongly encouraged to proactively assess their full product portfolio. These assessments are to ensure that products are properly classified and that necessary infrastructure is established to manage the new requirements, including Clinical Evaluation, Quality Management Systems, Post-Market Surveillance and Post-Market Clinical Follow-up. Yet, the industry is still waiting for a number of planned guidelines being released from the Medical Device Coordination Group (MDCG).

Between 2018 and 2020, the MDCG released about 60 different guidelines on how to implement the requirements under the new E.U. regulations. However, according to their ongoing guidance plan, about 48 are still in development to be released during 2021.

On top of this comes the burden of securing expertise and resources to comply with the General Safety and Performance Requirements. These requirements demand an estimated 2-4 times more working hours for medical device manufacturers. The MDR and the IVDR require much more documentation than current Directives. This holds true for both technical documentation for conformity assessment and post-market procedures as well as information intended for users of devices and for the general public via the EUDAMED database.

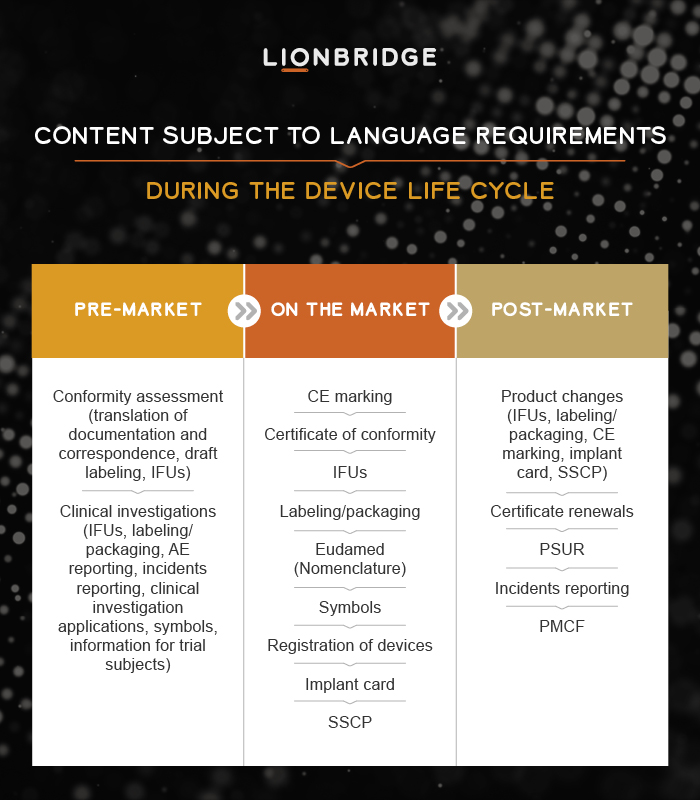

Plan and Centralize Translations Throughout Your Device Life Cycle

Launching medical technologies in the E.U. entails entering a multilingual market with 24 different official languages. Because the E.U. is founded on a multilingual policy, by default each Member State determines specific language requirements, which the MDR/IVDR generally do not address.

Article 41 of the MDR encourages the use of a “commonly understood Language” without defining what this means. Also, some MDCG guidelines state specific language requirements. Determining which content to translate into which languages for which type of devices can therefore be a burden for manufacturers that rarely have inhouse translators to accommodate the multilingual E.U. market.

We see clients asking Lionbridge for advice on language and how to manage translations across all the different content types required throughout the device life cycle. The search for clarity on language requirements is understandable; poor or inaccurate translations can delay product launches or cause incorrect or unsafe use of devices.

Another challenge with the MDR/IVDR is the dependency and interconnection between different types of content and reporting during product updates. Product changes may impact Instructions for Use and trigger updates across other content sources such as the Summary of Safety and Clinical Performance, Implant Card, Post-Market Clinical Follow-Up or the Clinical Evaluation Plan. Any such changes require control of source documents as well as updated translations. This is where a translation plan and centralized translation procedures are encouraged.

Who determines the language requirements in the updated MDR?

In the current and future MDR landscape, Lionbridge sees three different levels of language requirements that call for planning by manufacturers. The Union level language requirements are found in the MDR itself as well as in MDCG guidelines. National level language requirements are currently determined under the E.U. Directives and local requirements will need to be determined by each Member State under the MDR. The lowest level of language requirements is the device level.

Since translations will follow the increased documentation required for a device, especially for high-risk devices and depending on the user of the content, the burden of translations may vary across the product pipeline. Lionbridge encourages a dialogue with clients already in the pre-approval phase of the medical device to avoid delays, inconsistencies and to drive efficiencies throughout the product life cycle.

Although the DoA for updates to the MDR and IVDR was delayed, companies cannot afford to take the same approach. The cascading effect of changing documentation and regulations on translation requirements makes planning essential. That’s where the Lionbridge Life Sciences team comes in. We’re here to simplify the process in a world recently turned upside-down by the COVID-19 pandemic.

Reach out to us today and make sure your team is well-prepared for the latest E.U. regulations.